Backtesting strategies for trading in crypto trading involves simulating an investment strategy using historical data to determine its possible profitability. Here are a few steps to test your strategies for trading in crypto. Historical data: Find historical data on the crypto asset that is being traded with, including prices and volumes.

Trading Strategy - Define the trading strategy being used, including the rules for withdrawal and entry, position sizing and risk management regulations.

Simulation Software: Make use of software to simulate the application of the trading strategy using the data from the past. This lets you see how your strategy would have performed in the past.

Metrics. Use metrics such as Sharpe ratio and profitability to determine the strategy's effectiveness.

Optimization: Change the parameters of the strategy to improve strategy performance.

Validation: Examine the effectiveness of the strategy using out-of-sample data to confirm the validity of the strategy.

It is important to remember that past performance cannot be used as an indicator of the future's performance. Backtesting results should not ever be relied on to predict future profits. It is equally important to take into account the effects of the volatility of markets as well as transaction costs and other real-world considerations when applying the strategy to live trading. Have a look at the top https://cleo.finance/ for more tips including best crypto leverage trading platform, stendex automated online trading, auto buy sell signal indicator, options on crypto, okex auto trader, tradestation automated software, bear bull traders reddit, best autotrading platform, developing algorithmic trading strategies, the best ea forex, and more.

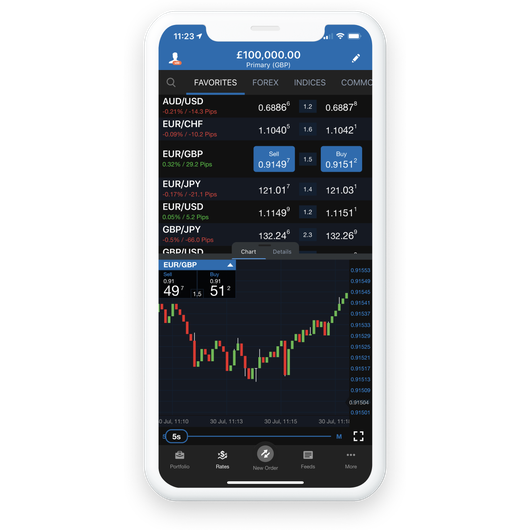

What Are The Functions Of Automated Trading Software's Cryptocurrency Trading Bots Function?

The bots for trading cryptocurrency work within automated trading software by following a set of predefined rules and executing trades on behalf of the user. Here's how they work. Trading Strategy The user selects the strategy to use for trading. This includes rules for entry and exit and the size of the position and risk management.

Integration APIs: The trading bot can be integrated with cryptocurrency exchanges. This allows it to gain access to real-time market data and then execute trades.

Algorithm: The robot utilizes algorithms to analyse market data and make choices in accordance with the trading strategy.

Execution: The robot executes trades automatically based on the trading plan without any intervention from a human.

Monitoring The trading bot continuously monitors and adjusts to market conditions as needed.

Automated trading using cryptocurrency is extremely useful. They are able to execute complicated routine trading strategies, without the necessity of human intervention. Automated trading comes with its own risks. This includes the potential for software mistakes as well as security weaknesses. Additionally, there is the possibility of losing of control over trading decisions. Before you decide to use any trading bot for live trading, it's essential to thoroughly evaluate and test it. Read the best backtesting recommendations for more tips including macd automated trading, tradingview auto, auto robot trading tool, grid trading strategy binance, trading system forum, trade brains discussion forum, coinbase auto trading, forex spread betting forum, cryptocurrency trading platform, forex forum sites, and more.

[img]https://www.investopedia.com/thmb/LNbzJ1Uh4sikReLLzleAjxtM7Vw\u003d/500x334/filters:no_upscale():max_bytes(150000):strip_icc()/shutterstock_274220507-5bfc33a546e0fb00517d6e77.jpg[/img]

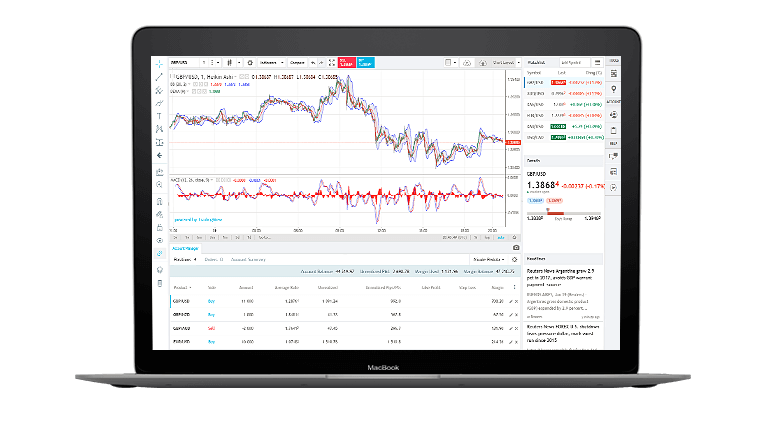

What Exactly Is An Automated Trading Bot? On What Software Platforms?

A trading robot is a program on a computer designed to perform trades on behalf of a trader. It is designed using pre-defined guidelines and algorithms. These bots are designed to analyze market data, such as price charts and technical indicators, and make trades according to the rules and strategies established by the trader.Automated trading bots can operate on a variety software and platforms, depending on the programming language and trading platform that is used. C++, Java and Python are some of the most popular programming languages utilized by automated trading bots. The trader's preferences and compatibility with the platform will decide the choice of software or platform.

There are many platforms and programs that can be used in order to run automated trading robots. They include:

MetaTrader is a popular trading platform that allows traders to create automated trading bots using the MQL programming interface.

TradingView: This platform allows traders to create and execute trading strategies with their Pine Script programming language.

Cryptohopper is an online platform to automate the trading of cryptocurrency.

Zenbot: Zenbot, an open-source cryptocurrency trading system, can be customized and utilized on a range of platforms which include Windows as well as macOS.

Python-based library There are a variety of Python-based programs, like PyAlgoTrade or Backtrader which allow traders to design and run automated trading robots using the Python programming language.

The platform and software chosen will depend on the preference of the trader as will the compatibility of the exchange and trading platform. Take a look at the most popular that guy for automated forex trading for site recommendations including auto trading tools free, robinhood sell crypto, cheapest fees crypto exchange, best trading crypto platform, metatrader bot trading, gemini trading app, nifty automated trading system, top forex robot 2020, automated stocks, best crypto trading site, and more.

[img]https://www.istockphoto.com/photo/license-gm1317587887-?utm_medium\u003dorganic\u0026utm_source\u003dgoogle\u0026utm_campaign\u003diptcurl[/img]

What Exactly Is Crypto Reverse Testing Using Rsi Divergence Stop Loss And Size Of The Position?

The Relative Strength Index (RSI) as well as the stop loss and position formula for sizing crypto backtesting is a method of testing the effectiveness of a trading strategy using cryptocurrency. RSI Divergence is an analysis technique which analyzes the price of an asset with its RSI indicator. It is used to identify possible trend reversals. It can be used to limit losses if the market moves in a negative direction. The calculator can be used to determine the correct amount of capital to place on a trade. The calculation is on the basis of the trader's risk tolerance and their account balance.

These steps will allow you to test the trading strategy using RSI divergence and stop loss.

Determine the strategy for trading. Utilizing RSI Divergence Stop Loss, Stop Loss, and a position sizing calculator, determine the rules and requirements for a trade's entry or exit.

Gather historical data: Find historical price data on the cryptocurrency you wish to trade. The data is available from various sources, such as the data providers and cryptocurrency exchanges.

Backtest the strategy. Use R to backtest trading strategies using historical data. Backtesting can be performed with the RSI indicator as well as the stop loss.

Examine the results using backtesting to assess the profitability and risks associated with the trading strategy. The strategy can be adjusted if needed to improve its performance.

There are a variety of popular R packages available to backtest trading strategies such as quantstrat, TTR, and the blotter. These packages permit backtesting trading strategies by employing various risk management strategies and technical indicators.

In general using RSI divergence as well as stop loss and a position sizing calculator could be a useful method to design and test a trading plan for cryptocurrencies. It is important to check your plan with prior data before implementing it for live trading. Also, it is important to keep an eye on the market and modify the strategy when the market conditions alter. Take a look at the most popular full article about forex backtester for more recommendations including forex day trading forum, crypto trading tips reddit, automated fx, altcoin trader app, automated stock market trading, binary auto trading software, swing trading chat rooms, automated forex trading program, buy crypto low fees, robo trading software free, and more.

How Can You Create The Best Anaylse Trading With An Divergence Cheat Sheet

A RSI cheat sheet can be used to analyze divergence trading. It helps you discern buy or sell signals that are based solely on the price and RSI indicator. Here are the steps to follow: Understanding RSI divergence: RSI divergence refers to when the price of an asset and its RSI indicator move in opposite directions. Bullish divergence happens when the price is falling to lower lows , but the RSI indicator makes higher lows. Bearish divergence happens when the price makes higher highs, but the RSI indicator makes lower highs.

Utilize the RSI Diligence Cheat Sheet. There are many cheat sheets to aid in identifying the potential for buy or sell signals that are based on RSI diversity. A bullish divergence cheatsheet might recommend buying when the RSI indicators are crossing over 30 and the price is making a higher low. Conversely an inverse sheet could recommend selling when RSI indicators crosses lower than 70 and is making lower tops.

Locate Potential Buy/Sell Signals. If you've got a cheatsheet, you can make use of it to spot buy/sell signals based on RSI Divergence. For example, if you notice a bullish divergence signal on the chart, you could look into buying the asset. In the opposite direction, a bearish signal might suggest you consider selling the asset.

Confirm the Signal: Before executing a trade using the RSI divergence signal, it is important to confirm the signal by using other technical indicators or price action analysis. Other indicators, such as moving averages or levels of support/resistance could be used to confirm the signal.

Manage Risk. As with any trading strategy it is crucial to take care to limit the risks of RSI divergence. It is possible to do this by placing stop-loss orders to limit the possibility of losses, or by altering the size of your position according to your risk tolerance.

Analyzing divergence by using an RSI Divergence Cheat Sheet entails the identification of potential buy or sell signals based on the divergence of the price and RSI indicator, then verifying it using other technical indicators, or price action analysis. Before you employ this method for live trading it is crucial to know the risks involved and test it thoroughly with historical data. Have a look at the top rated view website about position sizing calculator for blog advice including trade ideas chat room, investing in cryptocurrency on etoro, world top crypto exchanges, best swap crypto, crypto margin trading, automated forex trading software for beginners, auto trading systems global, reddit best crypto exchange, shrimpy crypto, crypto available on robinhood, and more.

[youtube]mII4WabEtGM[/youtube]